How to Establish PT PMA(Foreign Company) in Indonesia?

Based on Law No. 25/2007 regarding Investment (New Investment Law), a foreign investment in Indonesia is defined as an investing activity conducted by a foreign investor for the purpose of running a business within the territory of Indonesia. The legal entity through which a foreign person, foreign company, or foreign government body can conduct business in Indonesia (meaning generating revenue streams and profit) is the PT PMA. The establishment of a PT PMA is regulated by Law No. 40/2007 regarding Limited Liability Companies (Company Law). Such a company can be either 100 percent foreign-owned or partially foreign-owned.

It is important to stress that various sectors in Indonesia are closed, or partially closed, to foreign investment. To find out which sectors are open to foreign investment you need to access the Negative Investment List (Daftar Negatif Investasi), a list compiled – and regularly revised – by the Indonesia Investment Coordinating Board (BKPM). In case a sector is partially closed to foreign investment, then the list states the maximum allowed percentage of foreign ownership. This means that you will need to have a local (Indonesian) partner in order to engage in business in that particular sector.

To recap, there are two basic questions a foreigner should ask oneself before investing in Indonesia:

1. What type of legal entity do we need?

A company (PT PMA) or a representative office (KPPA)?

- Do you plan to generate revenues, profit or engage in sales directly in Indonesia? then you need a PT PMA.

- Do you want to explore business opportunities in Indonesia for your foreign company (through market research, networking, etc.) without engaging in commercial transactions?

then it is better to establish a representative office (if such research shows positive results then you can decide to establish a PT PMA later on).

2. Is the sector we want to invest in open to foreign investment?

If yes, what is the percentage of ownership allowed to foreign investors?

For the answer, take a closer look at the Negative Investment List (latest revision done through Presidential Regulation No. 44/2016). If the sector requires partial domestic ownership, then you need a local partner.

Procedures for Setting up a Foreign Investment Company (PT PMA) in Indonesia

If, after considering the above questions, you decide to establish a foreign company in Indonesia, then you need to turn to the Indonesia Investment Coordinating Board (BKPM), which is the investment service agency of the Indonesian government and deals with foreign investment. Although the BKPM has recently improved its services, it can still be a hazardous undertaking for a foreigner (especially one who is new to Indonesia and is yet to learn the language and customs) to arrange all permits in a timely and smoothly manner. To avoid problems, most foreign investors prefer to use the services of a local company, one that is specialized in the setting up of a PT PMA or representative office, to deal with all procedures at the BKPM and other institutions (the foreign investor only needs to send all necessary documents to this local company). There are many local Indonesian companies that offer a “company establishment package” to foreign investors.

“Depending on sector, costs for the establishment of a PT PMA can vary, but generally such a package should cost around USD $3,000 and requires about ten weeks to be completed”.

You do not necessarily need to establish a PT PMA from scratch. You can also decide to acquire an existing PT PMA or an existing Perseroan Terbatas (PT). Regarding the latter, as the PT is a local limited liability company, it needs to be converted into a PT PMA after acquisition.

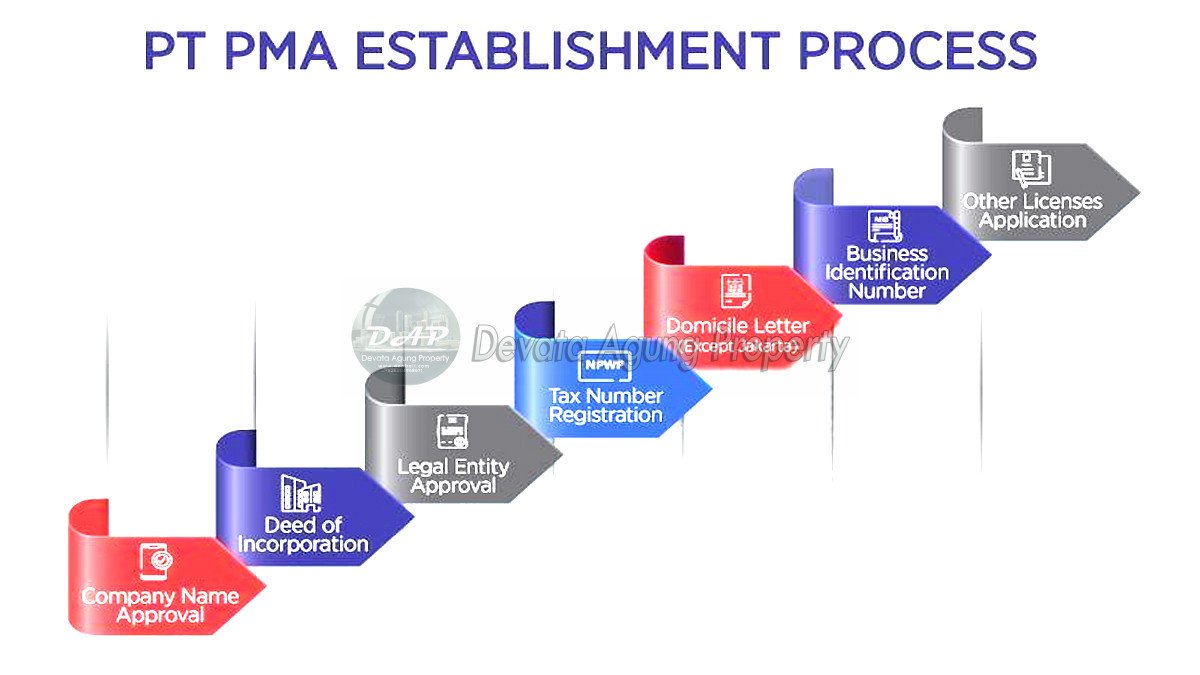

Generally, the following licenses/documents are required for the establishment of a PT PMA in Indonesia:

| Description | Estimated Time (days) |

| • Principle License & Business License from BKPM | 7 |

| • Deed of Establishment (containing the Articles of Association) legalized by a Public Notary | 1 to 2 |

| • Legalization of the legal entity status of the PT PMA by the Ministry of Law and Human Rights | 10 |

| • Domicile Letter from the local district authority | 3 |

| • Tax Identification Number (NPWP) and taxable entrepreneur confirmation (PKP) from the tax office | 3 |

| • Company Registration Certificate (TDP) from the agency for integrated licensing services (BPPT) | 14 |

| • Manpower Report and Company Welfare Report from the sub-department of the Ministry of Manpower | 7 |